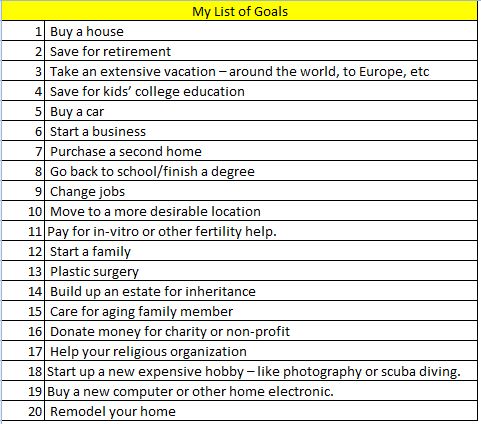

Step 1: Write down your goals

If you haven’t already, it is always advisable to sit down and write down all your financial goals and aspirations. For example:

When doing this exercise for yourself, I recommend hand writing these goals.

Step 2: Shortlist your goals

Once you have an exhaustive list like the one above, the next step is to highlight/circle 5 of the most important ones for you.

Step 3: Detailing your goals

Our next step is to categorize them into short term, medium term and long term goals. This is also the point wherein you write down in today’s terms how much these goals would cost.

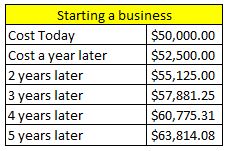

Step 4: Future costs

The next step is to make assumptions about how much this goal would cost. Let’s focus on the starting a business goal. You estimate that if you had 50000 USD to spare today, you’d feel confident about handing over your resignation letter to your boss and working on your startup idea. However, the longer you wait, the more that amount is likely to cost you due to inflation. Let’s assume you expect a 5% inflation on these costs. Using excel’s FV function, we can estimate the impact of inflation as follows:

Step 5: Determining Investment Required

The next step is to determine how much you should ideally be allocating towards this goal. Suppose you have access to a product/investment opportunity that allows you to save monthly and gives an estimated 6% annual return (after deducting all expenses). Then using excel’s PMT function we can ascertain the amount that we need to start investing in the above investment product as follows:

Step 6: Start investing

Based on the level of investible surplus you have on a monthly basis and the priority you assign to this goal, suppose you determine that you can set aside AED 4000 for this goal. You can expect to have the funding necessary for this goal in 4-5 years. Repeat this process for the rest of your goals and you’ll have created a basic financial plan charted out. With this plan as your road map, start investing and tracking your progress on a continuous basis.